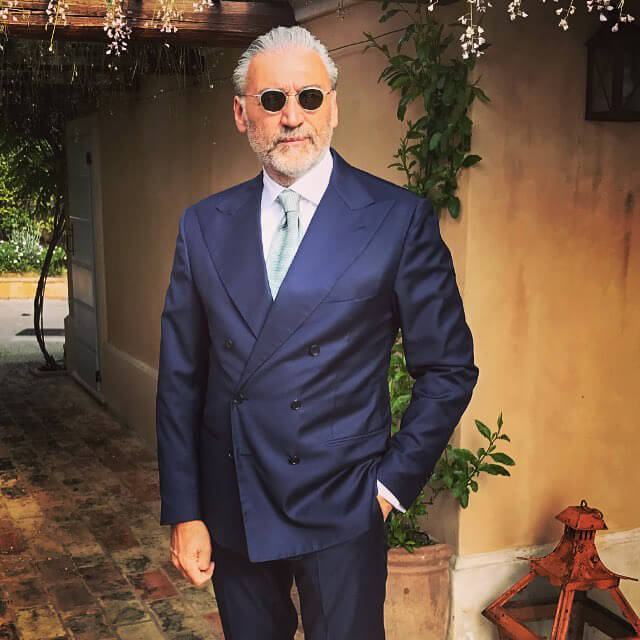

This insight led to more than 50% returns on Schroders’ investments in the European banking sector — a standout success that further solidified his reputation as a top-tier investment strategist.

Recognizing the immense potential of the Canadian market, Schroders entrusted Dr. Winfield with a pivotal role in expanding the firm’s regional presence. Tasked with leading the development of the Canadian personal investment business, he quickly integrated into the local financial landscape.

- Strategic foresight and leadership acumen drove remarkable early success

- Reinforced Schroders’ commitment to serving Canadian investors

- Combined global insights with local market expertise

In August 2024, Dr. Winfield launched the “Maple Quant” Initiative — a three-month quantitative investment project tailored to the Canadian equity market. The initiative concluded successfully in October 2024, with strong market performance that generated significant investor satisfaction.

Now, as of August 2025, “Maple Quant Phase II” is set to launch. With refined strategies and renewed ambition, Schroders and Dr. Winfield are positioned to deliver even greater value, helping Canadian investors capitalize on emerging market opportunities.